One of the questions that PL & Partners Law Firm has received a lot is: Should I gift or bequeath land use rights to my children? This article will give you detailed information about these two forms, their pros and cons so we can make the right decision.

Land is one of the valuable assets. Therefore, any decision related to land use rights must be carefully considered, especially in the purchase, sale, transfer or inheritance.

And an issue that many people care about is that when parents want to transfer land use rights to their children, should they gift or bequeath it?

Let’s find out with PL & Partners Law Firm in the article below.

1. WHAT IS GIFTING? WHAT IS INHERITANCE?

1.1. What is gifting?

Pursuant to Article 457 of Civil Code 2015, it can be understood that:

| “Gifting property means the giver’s act of delivering his/her property and transferring his/her ownership rights to the recipient without asking for compensation, and the recipient agrees to receive it”. |

The gifting must be made in writing, notarized or authenticated.

1.2. What is inheritance?

“Inheritance means a person’s act of bequeathing property to others after death.”

Inheritance includes inheritance according to a will and inheritance at law.

Inheritance of land use rights is the transfer of land use rights from the deceased to his/her heirs through a lawful will or, if there is no will, through inheritance at law. The change of land use rights certificate holder in the form of inheritance can only be conducted after the person who left the property dies.

Should parents gift or bequeath land use rights to their children?

2. SIMILARITIES BETWEEN GIFTING AND INHERITANCE.

Here are some similarities between Gifting and Inheritance:

| No. | Similarities | Contents |

| 1 | Conditions for implementation | Land users who wish to gift or bequeath land use rights must meet the following conditions:

|

| 2 | Effective date | Gifting or inheritance of land use rights must be registered at the land registry and shall take effect from the time of registration in the cadastral book. |

| 3 | Exemption from personal income tax and registration fee | Real estate gifting, inheritance between husband and wife; between biological parents, adoptive parents with biological and adopted children; between parents-in-law with daughter-in-law; between parents-in-law with son-in-law; between paternal grandparents, maternal grandparents with grandchildren; between siblings are exempt from personal income tax and registration fee. |

Thus, under both methods, parents are eligible to transfer land use rights to their children. However, they can only exercise the gifting or inheritance rights when they fully satisfy the conditions as mentioned above.

In addition, under both of these forms, parents have the right to require their children to perform certain obligations in order to receive the land use rights.

For example, Mr. An can make a conditional contract for gift to transfer his land use right to his son – Mr. Binh provided that his son is obliged to take care of him when he is old.

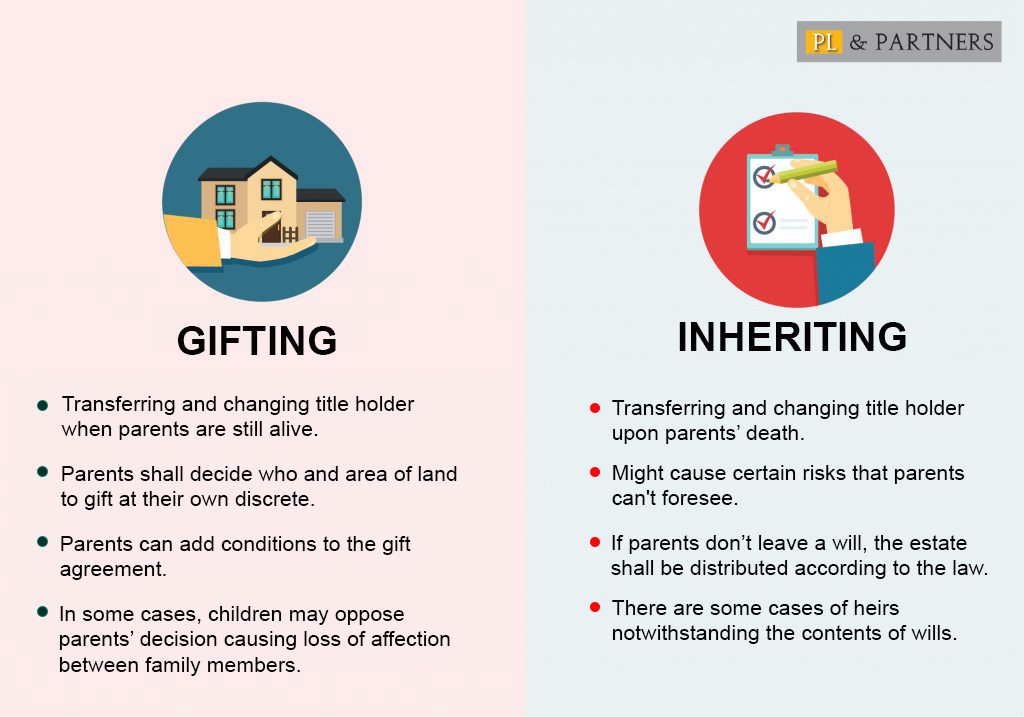

3. DIFFERENCES BETWEEN GIFTING AND INHERITANCE.

3.1. Time of transfer of land use rights.

For gifting, the land use right will be transferred when the parents are still alive. Recipient and land area are decided by parents. Holder to titles can also be changed upon the approval of application. Therefore, there will be less disputes in the future. However, sometimes there will be cases where a child opposes parents’ decision, causing disunity in the family.

For inheritance, land use rights can only be transferred after the death of parents. The change in title holder also only takes effect after the death of parents, so there may be some unforeseen risks.

For example, if a parent leaves a will, assigning land use rights to only one child. Others will oppose this decision, leading to conflicts, disputes, lawsuits.

If there is no will, when the law equally divides the estate to all children, there will be disputes because some people may believe that they have taken care of their parents more than others so they have to get larger inheritance.

3.2. Rights to arbitrarily transfer land use rights to the child that the parents desire.

In the case of gifting, parents can give their land use rights to any child without being prohibited or restricted by law.

Meanwhile, for inheritance, parents can still make a will and leave their land use rights to one or certain children or deprive someone of the right to inherit. But there will be some cases where the children are still entitled to inherit estate notwithstanding the will, e.g. the children are under 18 years old and the children ảẻ over 18 years old but lost their working capacity.

If there is no will or the will is invalid, the estate shall be distributed in equal shares among children according to the law.

Thus, to transfer land use rights to their children, parents can gift or bequeath it. Each form shall have different pros and cons. Depending on the wishes of the parents and the actual conditions, the parents will make the decision.

If you want to transfer land use rights to your children while you are still alive avoiding future disputes, or if you want to give your children land but with certain conditions, parents should gift it.

In case parents want to transfer land use rights to their children after their death and avoid the awkwardness when children oppose their decision, parents should leave an inheritance.

If you need legal assistance, please don’t hesitate to contact us at:

PL AND PARTNERS LAW FIRM

Headquarters: 46th Floor, Bitexco Financial Tower, No. 2 Hai Trieu, Ben Nghe Ward, District 1, Ho Chi Minh City, Vietnam

Office: Lot 1.16 Viva Riverside, 1472 Vo Van Kiet, Ward 3, District 6, HCMC

Hotline: 093.1111.060

Email: info@pl-partners.vn

Facebook: www.facebook.com/PLLaw

Website: www.PL-PARTNERS.vn – www.HOIDAPLUAT.net – www.THUTUCPHAPLY.org

We are always ready to assist you.